My plan to pay off my vehicle loan ahead of schedule

I know finances are difficult for very many people, many of my friends are currently struggling just to make ends meet. I am very thankful that I currently have a job that pays me just enough to live comfortably and not feel the stresses of paying off large loans. I do make less than the median income level for my area, but thankfully have support of a significant other who has the housing situation in good shape so that I do not have to pay rent.

So, this all started one day in May 2018 when I felt I needed to buy a new car. The one I had been driving was getting older, but truthfully had plenty of useful life left in it. I could have paid the few thousand dollars just to repair the vehicle and continue on happy without a vehicle loan hanging over my head.

But alas, I had a very good job that was paying me right at the median income level for my area and I felt it was time for me to make an upgrade and purchase what I hope will be my last new car ever. I was nearing 50, and most cars last about 10 years in this area if taken care of properly. I figured I was making good enough money and could easily pay the monthly loan and higher insurance rates of a new vehicle.

However, jobs are not a guarantee. Especially in our current economy. It was in December of 2018 that I was laid off of work with no income source in mind. I had worked at this place for 10 years and was very good at my job. But as it was explained to me, the company needed to outsource my position to a contract company due to finances. So there I was, suddenly jobless and a large vehicle loan over my head to worry about.

I was bound and determined not to let this car get repo’d and loose what I have dreamt of owning for many years. I had a plan, of which I set forth approximately a year before I made the purchase. See, this is where it starts, the planning in advance for situations that you hope never arrive. The day you loose your job!

I had a few goals of what I wanted for my life, and I started making plans for how I was going to achieve these goals. I knew that I wanted to help my fiance get out of the house we were in and into a larger piece of property just outside of town where we could relax and enjoy working out in a larger garden. I also wanted to once again own a Jeep Wrangler. And last but not least, retire in 5 years. The later of which was just that, a goal and not one that I really thought i could accomplish before the age of 55.

I was making a good amount of money at the time and was able to start a savings plan. I was paying out a bunch more than I should have been at that time for dinner out to eat and sending money to my sons as they needed. In hind sight, I really should have been frugal with my funds and stashed away more sooner. At one time I was under poverty level income, and was lucky to have enough money to buy bulk groceries at the cost efficient stores. It was when i started making some good money that I lost my whits and started spending beyond the means, instead of saving money quickly. So let this be the first lesson, the more money you make the more you should be putting away into savings!

Now, I am not a financial advisor or have any sort of qualifications to help anyone get rich quick, but I do think I have a good head on my shoulders and believe my latest plan is far better than what I have done in the past. I really should start talking to an official financial planner and do this the correct way, but I do have the comfort level as of now to do this sort of on my own as a self taught learning experience. I will likely however and hopefully soon talk to a few Lodge Brothers that are in the business to make money for their clients and get some better advice. But let’s see how well my plan works for now, as an experiment to see if someone without the knowledge like me can at least start working towards the right path.

So for a few details. Like I said, I started off by saving to pay for the Jeep with cash. I did the research in advance starting in 2017 to see what prices for Jeeps were and how long it would take me to save at my then current jobs income level. I felt comfortable that I could save enough money within a couple years to almost pay for it all at once without a loan. I finally had about 1/3 of the money saved when I notice some upcoming changes to the Jeep lineup that were planned in 2018/2019. The Jeep Wrangler JK was no longer going to be produced after April 2018.

I made the first mistake, and I let my emotions get the best of me. I justified the rash decision with the knowledge that the newer Wrangler JL would be almost $5-8K more and that I needed to jump quickly to buy the Jeep JK at a good price before rates went up. I found one at $27,000 that I liked. It was the bare bones Wrangler but with a hard top and A/C. So I decided to go ahead and jump in ahead of time because I knew at the rate that I was saving money I could pay the monthly loan and still be able to drop a few bucks into savings to continue to build it up. The goal being that I wanted to have as much money in savings as what the payoff for the loan will be.

I needed to have a loan, as I went into bankruptcy about 5 years prior dealing with an ex-wife’s irresponsible act of letting our vehicle get repo’d and being that the loan was in both our names I no longer wanted to keep paying on something that she let go. I had been improving my credit rating ever since with various credit cards, and felt it was time to get a vehicle loan that I felt comfortable paying on to help increase my rating so that I could buy that house for my soon to be new wife and I.

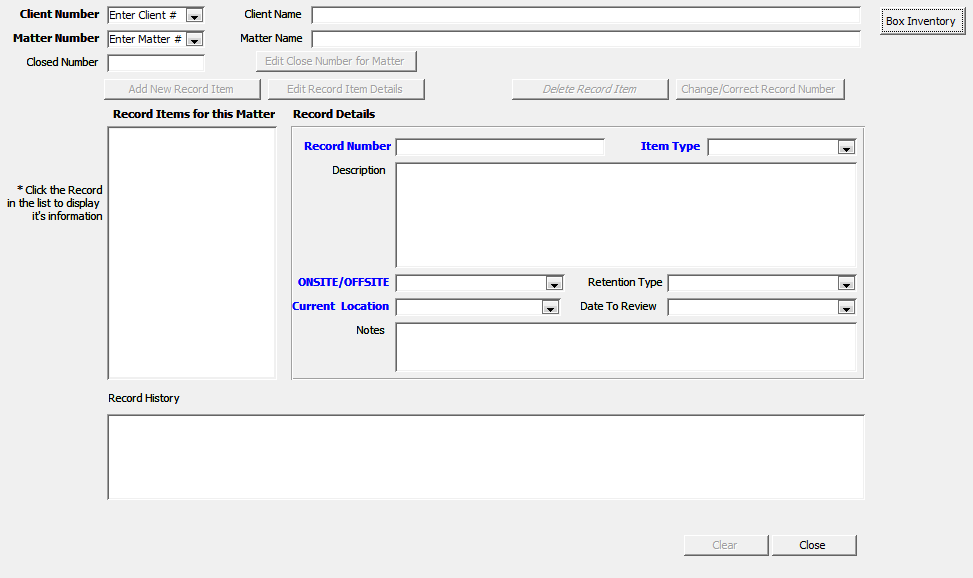

I found out in the past, that many loan companies will allow you to pay as often as you can and at any amount, as long as the total per month is the same as you would have paid monthly or greater. So I resigned to paying that monthly amount, but breaking out that payment into weekly payments.

This way, I was not having to pay more than I would have already been assigned to pay each month but that by breaking that amount out into weekly payments it was that much less that I was paying upon the principal. Granted, the first year of doing this no matter how you break your payments out the loans are designed in such a way that you don’t really start paying on the principal amount until at least a year or so out.

This really does work, I have done it in the past and continue to do this today. I pay more often on the loan, but I only need to pay the approximately 1/4 of the amount each week to total my monthly payment. In doing it this way I will shorten the full length of time I will be paying on the loan. Because, when you only pay monthly you are paying for 30 days of full interest. Whereas, if you pay each week one fourth you are paying off early 7 days of interest that are not compounded into the next.

While this is not exactly how it works, imagine it this way. Suppose you have $20,000 remaining and yearly interest rate is 10% on your loan. Your daily interest after 7 days is about $35 dollars for that week. If you paid each week, then by the end of the month you would pay approximately $140. But if you were to wait until the end of the month, you would pay almost $165 in interest because it is calculated daily on the amount you owe in total each day accumulated. In this scenario, you would save almost $15 per month just by paying each week. Does not sound like much, but that is an extra $180 for the year you could do something else with. But it is actually better than this, because interest is calculated daily, the sooner you pay off any additional fees, the less you pay in total interest. This means you actually can pay off your loan far in advance of the planned time frame set by the loan company.

For me, I choose to pay $200 per week. I know I know, how do you have that much money to pay each month. Well, I live as frugal as I can and spend as little as I need. Thankfully, I do not have rent. I do have other utilities bills that I pay, but it is the lack of rent that I use to pay for the vehicle. What I should pay each week is actually less. My monthly rate is actually $500, but I took that amount and multiplied that by 12 months which is $6000 for the year. I then divided the yearly by 52 weeks, which is about $115 per week. But by paying almost $300 per month more by bumping that weekly up to $200 I have set myself up that after a year of doing this my next car payment does not really have to be for another 6 months. That is correct, after one year of extra payments (only $300 per month more), I was able to extend my next payment due out to 6 months.

So this means, that I do not have to make any payments for at least 6 months and still be considered in good standing with my loan. But that is not the intent of my goal to get ahead. What happens if I was to loose my job again? I would not have any income to pay $500 per month on my loan. I now have a 6 month cushion to look for work before I start to have to worry about my car loan.

Now to be fair, I am really excelerating my payments far more than many people can. But if you were to only take what you owe and break it down to weekly payments instead of monthly that little bit will add up. If you look at my earlier supposed example of a $20,000 left on your payments at 10% rate you were saving almost $15 per month. After 10 months that may just be the amount saved to equal at least one month ahead of schedule on your loan. You are not paying more in total each month, but you are really gaining an advantage over your loan. And think of this, just add an extra $5-10 per week and you can drop it down quicker to being a month ahead in only a few short months quicker. The key is to pay more sooner, so that you can relax a little later. Try not to relax too much as you will eventually loose all that you gained if you don’t stay on top of it. But it does feel real good knowing that I am 6 months ahead of my loan.

But how did I come to that $200 per week that I should pay on my loan. Well besides the fact that my monthly divided out is about $120 per week I knew that I had to at least pay that amount or more each week to stay ahead. So, I took my salary (which I only get paid once a month) and figured out what I make each week in income. And then I did something else totally helpful, I simplified my bill payments and any random expenses to use one and only one credit card. So I split my income of say approx. $500 per week take home pay. $210 goes to checking account ‘B’ that I will pay the loan from (and that is the only payment with that account). I then pay my credit card balance off at a rate of $280 per week. That leaves me with another $10 per week in checking account ‘A’ as a backup for later.

The trick is to watch my credit card usage diligently so that I do not pay extra money in interest charges to that card. As long as you pay off everything you owe within the 30 days that you are charged an amount, you should not have to pay interest on that amount. So that means that each week, my total bills can only be $280. If I don’t owe that much, then I only pay what my current balance is and leave the remaining in checking account ‘A’ for later use. Why? Because unexpected expenses happen, it is a part of being an adult and paying bills. And lately, I am getting a little worried because of a few large bills that I did not intend.

But by paying your credit card weekly gives you some great insight on where your charges come from and where you can slow down your extra charges. Some days, I have to forego any luxuries like beer or eating out. Or just not drive anywhere or go out. Maybe resign myself to eating Ramen noodles instead. But at least I am watching it weekly and making smart choices at that time. I probably could pay more attention and go out and buy bulk groceries again, but as I get older I just want to enjoy my life if I can. At least I am a bit comfortable with my current car loan payments and still have a job. But it will be when I loose my job again that I will have to be very cautious. Thankfully, because of how I have been managing my loan and how I have been saving money I think I can live as I currently do for about 4-5 months without a job. But I would highly recommend not waiting that long or I will loose all that I have gained for this experience.

Good luck and I wish you all the best in your journey to save for your dreams. Just remember to squirrel away as much as possible as early as possible to make your life easier.